Crypto prices have yet to react to the Fed decision to temporarily halt rate hikes; meanwhile, the S&P 500 steamrolled to a new 13-month high.

Powered by WPeMatico

Auto Added by WPeMatico

Crypto prices have yet to react to the Fed decision to temporarily halt rate hikes; meanwhile, the S&P 500 steamrolled to a new 13-month high.

Powered by WPeMatico

Investment bank MPS Capital Services has warned that the U.S. economy will be in a recession by year-end. The firm’s strategist predicts that the Federal Reserve will raise interest rates by an additional 25 basis points, warning that the central bank’s monetary tightening “will drag down on the economy.” Strategist’s Recession and Rate Hike Predictions […]

Investment bank MPS Capital Services has warned that the U.S. economy will be in a recession by year-end. The firm’s strategist predicts that the Federal Reserve will raise interest rates by an additional 25 basis points, warning that the central bank’s monetary tightening “will drag down on the economy.” Strategist’s Recession and Rate Hike Predictions […]Powered by WPeMatico

Elizabeth Warren, the Democratic senator from Massachusetts, has recently launched a political campaign against cryptocurrencies as she seeks a third term in office in 2024. In a recent interview on “Meet the Press Reports” with NBC’s Chuck Todd, Warren likened buying bitcoin to “buying air.” Despite her stated distrust of banks, Warren told the show […]

Elizabeth Warren, the Democratic senator from Massachusetts, has recently launched a political campaign against cryptocurrencies as she seeks a third term in office in 2024. In a recent interview on “Meet the Press Reports” with NBC’s Chuck Todd, Warren likened buying bitcoin to “buying air.” Despite her stated distrust of banks, Warren told the show […]Powered by WPeMatico

At around 7:30 a.m. ET, the price of bitcoin skyrocketed past the $27,000 range to a high of $27,025 per unit. Precious metals, or PMs, like gold and silver, also rose between 1.98% and 2.12% against the U.S. dollar over the past day. While many market observers are wondering why specific assets like PMs and […]

At around 7:30 a.m. ET, the price of bitcoin skyrocketed past the $27,000 range to a high of $27,025 per unit. Precious metals, or PMs, like gold and silver, also rose between 1.98% and 2.12% against the U.S. dollar over the past day. While many market observers are wondering why specific assets like PMs and […]Powered by WPeMatico

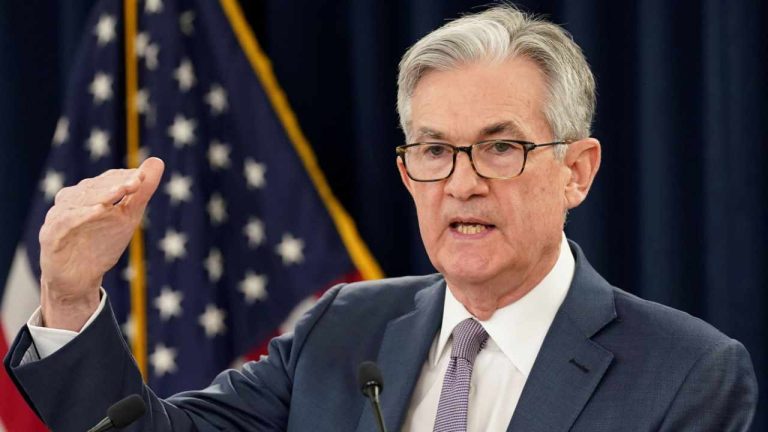

Media mogul Steve Forbes, chairman of Forbes Media, has warned that the Federal Reserve is “inflicting unnecessary pain” on the U.S. economy with its interest rate hikes after Fed Chair Jerome Powell said the Fed is prepared to raise interest rates at a faster pace. He also pointed out “the fundamental flaw in central bankers’ […]

Media mogul Steve Forbes, chairman of Forbes Media, has warned that the Federal Reserve is “inflicting unnecessary pain” on the U.S. economy with its interest rate hikes after Fed Chair Jerome Powell said the Fed is prepared to raise interest rates at a faster pace. He also pointed out “the fundamental flaw in central bankers’ […]Powered by WPeMatico

Federal Reserve Chairman Jerome Powell has warned that “the ultimate level of interest rates is likely to be higher than previously anticipated.” In addition, if faster tightening is warranted, the Fed “would be prepared to increase the pace of rate hikes,” Powell said. The Fed Anticipates Higher Rates, Faster Hikes Federal Reserve Chairman Jerome Powell […]

Federal Reserve Chairman Jerome Powell has warned that “the ultimate level of interest rates is likely to be higher than previously anticipated.” In addition, if faster tightening is warranted, the Fed “would be prepared to increase the pace of rate hikes,” Powell said. The Fed Anticipates Higher Rates, Faster Hikes Federal Reserve Chairman Jerome Powell […]Powered by WPeMatico

Bank of America, Goldman Sachs, JPMorgan, and UBS have shared their predictions about the Federal Reserve raising interest rates further. Bank of America and Goldman Sachs, for example, now expect the Fed to raise interest rates three more times this year. Major Banks Predict More Fed Rate Hikes As the U.S. Federal Reserve continues its […]

Bank of America, Goldman Sachs, JPMorgan, and UBS have shared their predictions about the Federal Reserve raising interest rates further. Bank of America and Goldman Sachs, for example, now expect the Fed to raise interest rates three more times this year. Major Banks Predict More Fed Rate Hikes As the U.S. Federal Reserve continues its […]Powered by WPeMatico

Last month, statistics showed that the Crypto Fear and Greed Index (CFGI) had a score of 25, indicating “extreme fear.” Thirty days later, with a 39% increase in bitcoin prices against the U.S. dollar, the current CFGI score on Jan. 30, 2023, is 61, reflecting “greed.” Crypto Fear Index Jumps to ‘Greed,’ Etoro Market Analyst […]

Last month, statistics showed that the Crypto Fear and Greed Index (CFGI) had a score of 25, indicating “extreme fear.” Thirty days later, with a 39% increase in bitcoin prices against the U.S. dollar, the current CFGI score on Jan. 30, 2023, is 61, reflecting “greed.” Crypto Fear Index Jumps to ‘Greed,’ Etoro Market Analyst […]Powered by WPeMatico

As investors examine the next move of the Federal Reserve, analysts, economists and market participants are also closely monitoring inflation levels. In Dec. 2022, the annual inflation rate dropped to 6.5%, and many experts predict it will decrease further. However, economist Mohamed El-Erian of the University of Cambridge believes inflation will become “sticky” in midyear, […]

As investors examine the next move of the Federal Reserve, analysts, economists and market participants are also closely monitoring inflation levels. In Dec. 2022, the annual inflation rate dropped to 6.5%, and many experts predict it will decrease further. However, economist Mohamed El-Erian of the University of Cambridge believes inflation will become “sticky” in midyear, […]Powered by WPeMatico

The Bloomberg analyst said Bitcoin is forming a bottom similar to how it looked prior to the 2019 bull run but with one major difference in the markets.

Powered by WPeMatico