Based on the latest data, the yield curve of the U.S. Treasury, which charts the yields for two-year and ten-year bonds, has remained inverted for a total of 656 days. This latest inversion joins previous records set in 1929, 1974, and 2008, all of which preceded substantial declines in the stock market. Recently, market observers […]

Based on the latest data, the yield curve of the U.S. Treasury, which charts the yields for two-year and ten-year bonds, has remained inverted for a total of 656 days. This latest inversion joins previous records set in 1929, 1974, and 2008, all of which preceded substantial declines in the stock market. Recently, market observers […]Historic Yield Curve Inversion Reaches 656 Days, Echoing Pre-Stock Market Crash Patterns

Based on the latest data, the yield curve of the U.S. Treasury, which charts the yields for two-year and ten-year bonds, has remained inverted for a total of 656 days. This latest inversion joins previous records set in 1929, 1974, and 2008, all of which preceded substantial declines in the stock market. Recently, market observers […]

Based on the latest data, the yield curve of the U.S. Treasury, which charts the yields for two-year and ten-year bonds, has remained inverted for a total of 656 days. This latest inversion joins previous records set in 1929, 1974, and 2008, all of which preceded substantial declines in the stock market. Recently, market observers […] As each day unfolds, analysts, economists, Wall Street institutions, and Fed watchers have increasingly postponed their forecasts for when the U.S. Federal Reserve will reduce the benchmark interest rate. Current data suggest that a rate cut in June is unlikely, with odds standing at 50-50 for a reduction in July. Financial Analysts Question Timing of […]

As each day unfolds, analysts, economists, Wall Street institutions, and Fed watchers have increasingly postponed their forecasts for when the U.S. Federal Reserve will reduce the benchmark interest rate. Current data suggest that a rate cut in June is unlikely, with odds standing at 50-50 for a reduction in July. Financial Analysts Question Timing of […] A new analysis by Bitfinex researchers predicts a 160% surge in bitcoin’s price in the upcoming 12-14 months, potentially reaching over $150,000 per unit. This forecast, derived from historical data and statistical models related to previous Bitcoin halving events, suggests a bullish future for the world’s leading digital currency. Bitfinex Researchers See Bitcoin Soaring Past […]

A new analysis by Bitfinex researchers predicts a 160% surge in bitcoin’s price in the upcoming 12-14 months, potentially reaching over $150,000 per unit. This forecast, derived from historical data and statistical models related to previous Bitcoin halving events, suggests a bullish future for the world’s leading digital currency. Bitfinex Researchers See Bitcoin Soaring Past […] Inflation in the U.S. has remained persistent, experiencing increases in the first two months of 2024, prompting members of the U.S. Federal Reserve to exercise caution against premature rate reductions. Federal Reserve Governor Michelle Bowman has voiced considerations for elevating interest rates, diverging from market anticipations of rate reductions within the year. Bowman’s concerns primarily […]

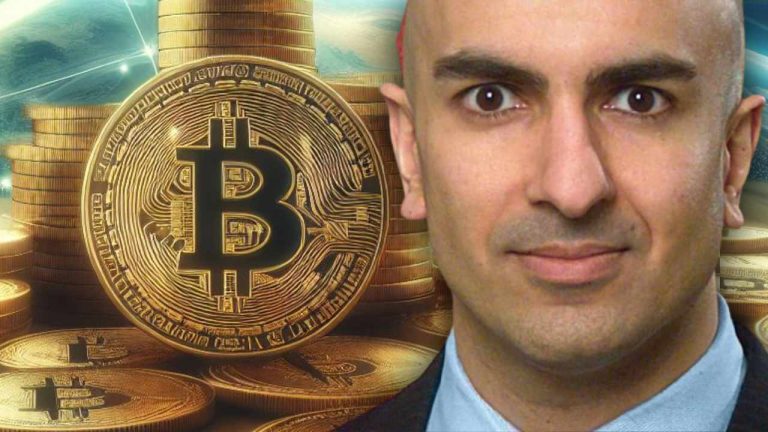

Inflation in the U.S. has remained persistent, experiencing increases in the first two months of 2024, prompting members of the U.S. Federal Reserve to exercise caution against premature rate reductions. Federal Reserve Governor Michelle Bowman has voiced considerations for elevating interest rates, diverging from market anticipations of rate reductions within the year. Bowman’s concerns primarily […] The president and CEO of the Federal Reserve Bank of Minneapolis, Neel Kashkari, has expressed concern about consumer risk due to “fraud, hype, and confusion” surrounding bitcoin. Moreover, he said the cryptocurrency has been around for more than a decade but “there’s still no legitimate use case in an advanced democracy.” ‘I Am Worried From […]

The president and CEO of the Federal Reserve Bank of Minneapolis, Neel Kashkari, has expressed concern about consumer risk due to “fraud, hype, and confusion” surrounding bitcoin. Moreover, he said the cryptocurrency has been around for more than a decade but “there’s still no legitimate use case in an advanced democracy.” ‘I Am Worried From […] Attention is riveted on the Federal Reserve’s assembly set for May 1, with widespread anticipation that the U.S. central banking authority might lower the federal funds rate at this juncture of the year. Currently, market forecasts suggest a rate reduction is very unlikely, and Cleveland Federal Reserve President Loretta Mester has expressed her inability to […]

Attention is riveted on the Federal Reserve’s assembly set for May 1, with widespread anticipation that the U.S. central banking authority might lower the federal funds rate at this juncture of the year. Currently, market forecasts suggest a rate reduction is very unlikely, and Cleveland Federal Reserve President Loretta Mester has expressed her inability to […] Economist and gold bug Peter Schiff has warned that something big is happening that very few investors are prepared for. “More importantly, governments and central banks are not prepared for it either,” he stressed. Schiff explained that Fed rate cuts will make the inflation problem worse. Peter Schiff’s Warnings Economist and gold bug Peter Schiff […]

Economist and gold bug Peter Schiff has warned that something big is happening that very few investors are prepared for. “More importantly, governments and central banks are not prepared for it either,” he stressed. Schiff explained that Fed rate cuts will make the inflation problem worse. Peter Schiff’s Warnings Economist and gold bug Peter Schiff […] In a significant ruling, a federal judge has dismissed Custodia Bank Inc.’s claim for entitlement to a Federal Reserve master account, marking a setback for the Wyoming-based depository institution. Custodia Bank argued that the Federal Reserve Bank of Kansas City (FRBKC) was legally obliged to grant its application for a master account, a critical financial […]

In a significant ruling, a federal judge has dismissed Custodia Bank Inc.’s claim for entitlement to a Federal Reserve master account, marking a setback for the Wyoming-based depository institution. Custodia Bank argued that the Federal Reserve Bank of Kansas City (FRBKC) was legally obliged to grant its application for a master account, a critical financial […] In a recent analysis, economist Peter Schiff draws stark comparisons between the current U.S. economic optimism and the prelude to the 2008 financial crisis. Schiff, leveraging his expertise, warns of impending financial turmoil, emphasizing the critical role of money supply in understanding economic health. Peter Schiff Warns: U.S. Economy on the Brink, Echoes of 2008 […]

In a recent analysis, economist Peter Schiff draws stark comparisons between the current U.S. economic optimism and the prelude to the 2008 financial crisis. Schiff, leveraging his expertise, warns of impending financial turmoil, emphasizing the critical role of money supply in understanding economic health. Peter Schiff Warns: U.S. Economy on the Brink, Echoes of 2008 […] On Wednesday, March 20, 2024, the Federal Open Market Committee (FOMC) declared that there will be no change to the federal funds rate for the time being. The committee emphasized its intention not to lower the target rate until there is “greater confidence that inflation is moving sustainably” toward the 2% target. Fed Pauses Rate […]

On Wednesday, March 20, 2024, the Federal Open Market Committee (FOMC) declared that there will be no change to the federal funds rate for the time being. The committee emphasized its intention not to lower the target rate until there is “greater confidence that inflation is moving sustainably” toward the 2% target. Fed Pauses Rate […]