Elvira Nabiullina, head of the Russian central bank, has stated that the mass launch of the digital ruble will take five to seven years. This appears to contradict recent suggestions by the chairman of the State Duma Committee on the Financial Market that the launch will begin next year. No Decision Before 2025 Elvira Nabiullina, […]

Elvira Nabiullina, head of the Russian central bank, has stated that the mass launch of the digital ruble will take five to seven years. This appears to contradict recent suggestions by the chairman of the State Duma Committee on the Financial Market that the launch will begin next year. No Decision Before 2025 Elvira Nabiullina, […]Russian Central Bank Chief: Mass Adoption of Digital Ruble Expected in 5 to 7 Years

Elvira Nabiullina, head of the Russian central bank, has stated that the mass launch of the digital ruble will take five to seven years. This appears to contradict recent suggestions by the chairman of the State Duma Committee on the Financial Market that the launch will begin next year. No Decision Before 2025 Elvira Nabiullina, […]

Elvira Nabiullina, head of the Russian central bank, has stated that the mass launch of the digital ruble will take five to seven years. This appears to contradict recent suggestions by the chairman of the State Duma Committee on the Financial Market that the launch will begin next year. No Decision Before 2025 Elvira Nabiullina, […] The real-world assets platform, Gluwa, is exploring the potential to assist in the development and launch of Liberia’s central bank digital currency. To increase the likelihood of the digital currency’s success, Gluwa is also considering the launch of a satellite-based internet service. Making the Digital Currency Compatible with Liberia’s Mobile Money System Gluwa, a real-world […]

The real-world assets platform, Gluwa, is exploring the potential to assist in the development and launch of Liberia’s central bank digital currency. To increase the likelihood of the digital currency’s success, Gluwa is also considering the launch of a satellite-based internet service. Making the Digital Currency Compatible with Liberia’s Mobile Money System Gluwa, a real-world […] Gluwa, a platform for real-world assets, announced on March 7 its partnership with the Central Bank of Nigeria. The partnership arrangement aims to improve the functionality of the Nigerian central bank’s digital currency and promote financial innovation through blockchain technology. Improving the CBDC’s Utility Gluwa, a real-world assets platform, has entered into a partnership arrangement […]

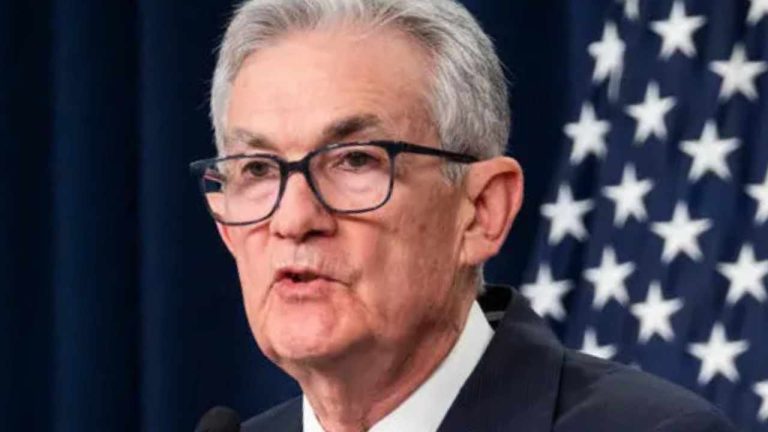

Gluwa, a platform for real-world assets, announced on March 7 its partnership with the Central Bank of Nigeria. The partnership arrangement aims to improve the functionality of the Nigerian central bank’s digital currency and promote financial innovation through blockchain technology. Improving the CBDC’s Utility Gluwa, a real-world assets platform, has entered into a partnership arrangement […] Federal Reserve Chairman Jerome Powell engaged with the Senate Banking Committee, signaling that the U.S. is just beginning to contemplate the introduction of a central bank digital currency (CBDC). Powell Assures No Direct Fed Accounts in CBDC Plans, Seeks Congressional Go-Ahead In his conversation with the Senate Banking Committee, Fed Chair Jerome Powell explored the […]

Federal Reserve Chairman Jerome Powell engaged with the Senate Banking Committee, signaling that the U.S. is just beginning to contemplate the introduction of a central bank digital currency (CBDC). Powell Assures No Direct Fed Accounts in CBDC Plans, Seeks Congressional Go-Ahead In his conversation with the Senate Banking Committee, Fed Chair Jerome Powell explored the […] The CBDC Anti-Surveillance State Act has been reintroduced in the Senate with the support of five U.S. senators. “As Americans face the prospect of an increasingly weaponized government, ensuring financial privacy is pivotal,” said one senator who supports the bill. A central bank digital currency (CBDC) “would open the door for the federal government to […]

The CBDC Anti-Surveillance State Act has been reintroduced in the Senate with the support of five U.S. senators. “As Americans face the prospect of an increasingly weaponized government, ensuring financial privacy is pivotal,” said one senator who supports the bill. A central bank digital currency (CBDC) “would open the door for the federal government to […] A Federal Reserve governor has addressed crypto’s impact on the U.S. dollar’s dominance. Additionally, he expressed reservations about the need for a U.S. central bank digital currency (CBDC) and stated his opposition to banks holding bitcoin exchange-traded funds (ETFs) as their primary asset. Fed Governor on Crypto, CBDC, and the U.S. Dollar Federal Reserve Governor […]

A Federal Reserve governor has addressed crypto’s impact on the U.S. dollar’s dominance. Additionally, he expressed reservations about the need for a U.S. central bank digital currency (CBDC) and stated his opposition to banks holding bitcoin exchange-traded funds (ETFs) as their primary asset. Fed Governor on Crypto, CBDC, and the U.S. Dollar Federal Reserve Governor […] Federal Reserve Chairman Jerome Powell has provided an update to Congress members regarding the Fed’s central bank digital currency (CBDC) work. “If we’re going to have a CBDC, Congress needs to authorize it,” he stressed. Moreover, the Fed chair reportedly said that a framework for stablecoins is needed. Fed Chair Powell on US CBDC and […]

Federal Reserve Chairman Jerome Powell has provided an update to Congress members regarding the Fed’s central bank digital currency (CBDC) work. “If we’re going to have a CBDC, Congress needs to authorize it,” he stressed. Moreover, the Fed chair reportedly said that a framework for stablecoins is needed. Fed Chair Powell on US CBDC and […]